Millionaire Mission Mondays – February 12, 2024 (Week 2):

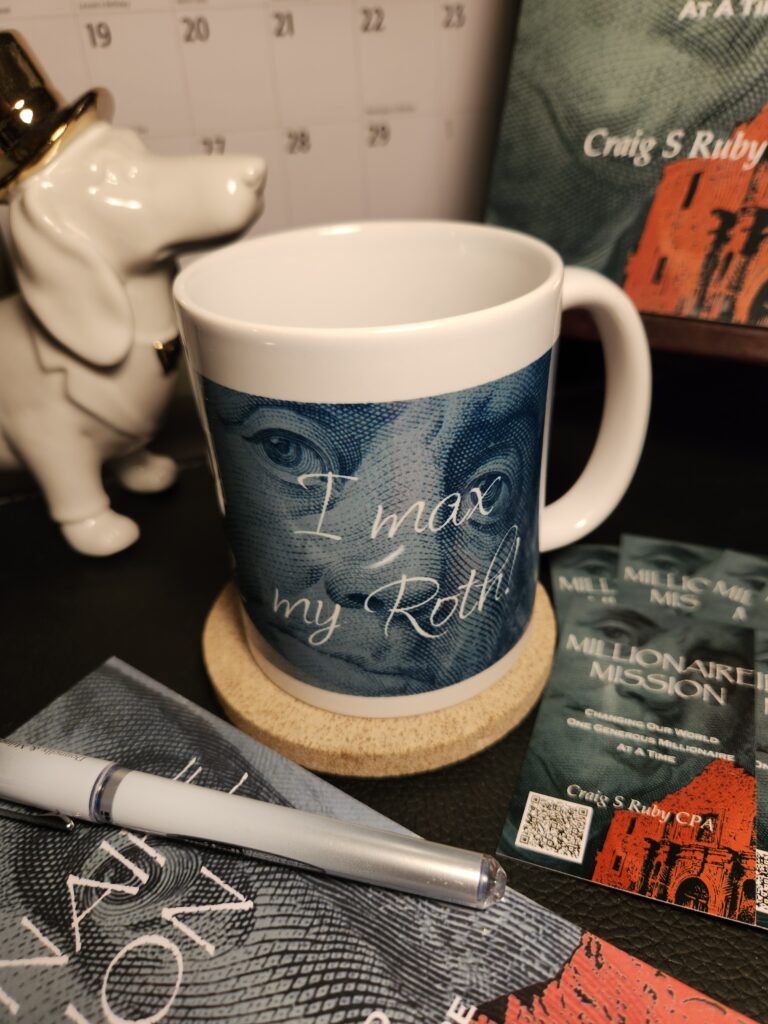

I wanted to know how many people who are filing US Tax Returns are really taking advantage of fully funding their Roth–IRAs. The US Treasury tells us that of the 7,118,775 taxpayers who contributed to their Roth–IRA in 2018 only 2,415,248 actually fully funded their Roth–IRA. That is only 33.9%. Most people are missing out on a great wealth building tool.

This is a tax break that everyone should be taking full advantage of. You may be able to contribute to a Roth–401k. If you can, do it. Otherwise, setup up your Roth–IRA and fund it to the Max!

Here’s why; contributions of $6,000 per year beginning at age 21 for 26 years that earns 12% Interest compounded annually will provide you with 1,010,244.17 by the end of age 46. (Exhibit IX on Page 64 of my book).

Imagine retiring at age 60 and living on 80% of the earnings, and its all tax free.

Here is the spreadsheet function to arrive at the result. [=FV(0.12,26,6000,0,1)*-1]